Dogecoin Price Prediction: Analyzing the Path to $0.50 Amid ETF Speculation

#DOGE

- Technical indicators show DOGE is oversold with MACD hinting at potential reversal

- ETF developments from 21Shares and Grayscale provide significant upside catalysts

- Network activity and whale movements remain key monitoring points for trend confirmation

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators Signal Potential Rebound

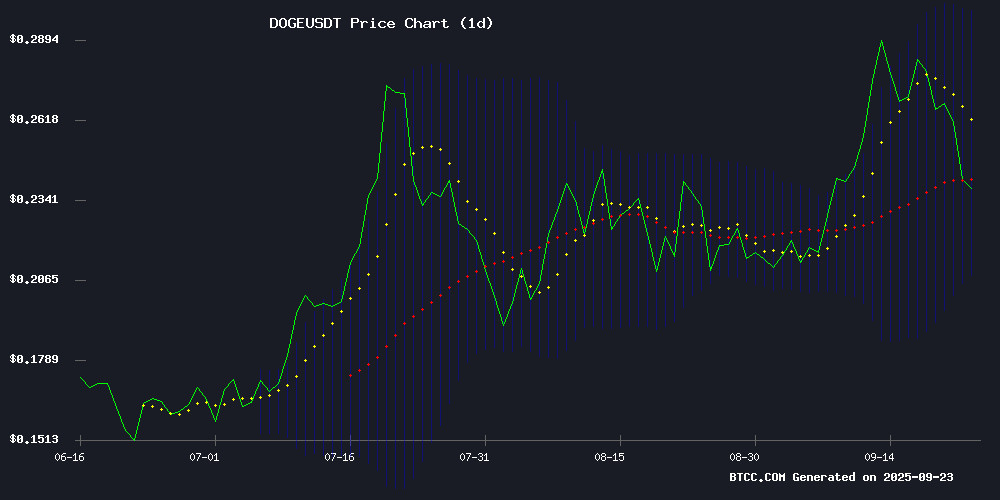

According to BTCC financial analyst Olivia, DOGE currently trades at $0.24025, below its 20-day moving average of $0.253799, indicating short-term bearish pressure. However, the MACD shows a slight bullish divergence with the histogram turning positive at 0.000993, suggesting weakening downward momentum. The Bollinger Bands position the current price NEAR the lower band at $0.208182, which often acts as a support level. Olivia notes that 'the convergence of MACD improvement and proximity to Bollinger lower band could signal an upcoming reversal if buying pressure increases.'

Mixed Sentiment as ETF Developments Counter Network Concerns

BTCC financial analyst Olivia observes conflicting signals from recent Dogecoin developments. 'The ETF filings from 21Shares and Grayscale create substantial bullish potential, particularly with the DTCC listing suggesting regulatory progress,' she states. However, Olivia cautions that 'whale selling and reduced network activity present near-term headwinds. The double top pattern mentioned in some reports does warrant caution, but the TD signal flashing green suggests technical recovery potential.' She emphasizes that 'ETF approval prospects could override current bearish technicals, creating a catalyst for the $0.50 target many are watching.'

Factors Influencing DOGE's Price

Dogecoin Shows Bullish Signal, Eyeing a Potential Breakout to $0.50

Dogecoin ($DOGE) is displaying strong bullish indicators, with analysts predicting a potential surge to $0.50. crypto analyst Ali Martinez highlighted an optimal entry point for traders, noting a supportive upward trend line on Binance's $DOGE/$USDT perpetual contract.

The meme coin currently trades around $0.24718, a strategic level for market participants anticipating upward momentum. Fibonacci extension levels further reinforce the bullish case, suggesting Dogecoin may be poised for significant gains in the near term.

TD Signal Flashes Green for Dogecoin – $0.50 Incoming?

Dogecoin's TD Sequential indicator flashed a buy signal as the meme cryptocurrency steadied near $0.24 after a recent decline. The 4-hour chart showed a red "9" candle at $0.238, a level historically associated with selling exhaustion.

Analyst Ali Martinez highlighted the significance of this technical pattern, noting similar signals preceded short-term rebounds. The 12-hour chart reveals key support at an ascending trendline dating back to June, reinforced by the 0.786 Fibonacci retracement level at $0.26.

With RSI exiting oversold territory, momentum appears to be recovering. Martinez projects consolidation between $0.26-$0.30 before a potential breakout attempt toward $0.31 resistance. A successful breach could open the path to higher targets at $0.38 and ultimately $0.50.

Dogecoin Price Forecast: DOGE Struggles Amid Whale Selling and Low Network Activity

Dogecoin's price hovers NEAR the 50-day EMA, but bearish technical indicators suggest further declines. Network activity remains subdued, with daily active addresses at 55,000—a stark contrast to June's peak of over 500,000. Whales are reducing exposure, exacerbating selling pressure.

Large holders (10M–100M DOGE) now control 15.86% of supply, down from 16.85% in July. While mid-tier whales (1M–10M DOGE) increased holdings through August, their share peaked at 7.3% on September 8 before dipping to 7.18%. Santiment data reveals this de-risking trend could thwart any near-term recovery.

The meme coin trades at $0.2400, down 21% from last week's high of $0.3072. Broader crypto market sentiment remains risk-off, leaving DOGE vulnerable to extended losses if whale outflows persist.

21Shares’ Spot Dogecoin ETF Hits DTCC—Will It Ignite A Rally?

21Shares' proposed spot dogecoin ETF has been listed on the Depository Trust & Clearing Corporation's (DTCC) pre-launch roster under the ticker TDOG. This procedural step prepares Wall Street's infrastructure for potential trading but does not imply regulatory approval.

The DTCC listing allows broker-dealers to begin operational checks, including ticker setups and clearing eligibility. However, the U.S. Securities and Exchange Commission (SEC) is still reviewing 21Shares' application, with no guarantee of approval or timeline.

Nasdaq filed a 19b-4 in April to list the ETF under commodity-based trust rules, and the trust's S-1 describes a physically backed product holding DOGE. The SEC extended its review in mid-August, while broader regulatory shifts occurred in September with the approval of generic listing standards for spot commodity and digital-asset ETFs.

Dogecoin (DOGE) Extends Losses – Is This the Final Shakeout Before Big Rally?

Dogecoin's price continues to slide, breaching key support levels as market sentiment sours. The meme cryptocurrency now trades below $0.2550, with technical indicators suggesting further downside potential unless bulls can defend the $0.2250 zone.

A bearish trend line has formed at $0.250 on the DOGE/USD hourly chart, with Kraken data showing consistent selling pressure. The current consolidation follows a 20% drop from recent highs, testing the resilience of retail investors who have championed the asset since its 2021 rally.

Market observers note the parallel declines in Bitcoin and Ethereum, suggesting broader crypto market weakness. For DOGE to reverse course, it must first conquer resistance at $0.2440, then overcome the psychological barrier at $0.260 - a level representing the 50% Fibonacci retracement of its recent fall.

21Shares Dogecoin ETF Hits DTCC — Is SEC Approval Next?

21Shares' Spot Dogecoin ETF has been listed on the Depository Trust & Clearing Corporation (DTCC), sparking speculation about potential SEC approval. The move signals growing institutional interest in meme-based cryptocurrencies, with Doge emerging as a focal point for ETF innovation.

Market observers note the DTCC listing typically precedes regulatory review, though the SEC's historical skepticism toward crypto ETFs remains a hurdle. The development follows a surge in altcoin ETF applications, reflecting demand for diversified crypto exposure beyond bitcoin and Ethereum.

Dogecoin Faces Bearish Pressure as Double Top Pattern Emerges

Dogecoin's price action has triggered alarms among technical analysts, with a pronounced double top formation signaling potential downside. The memecoin plunged to $0.238 amid a 9.5% daily drop, breaching what analyst Merlijn The Trader identifies as a critical neckline near $0.27. This textbook bearish pattern suggests further weakness unless DOGE achieves a daily close above $0.28—a level now acting as formidable resistance.

Contrasting views emerge from chart watchers noting a successful retest of a multi-month descending trendline. The $0.24-$0.25 zone now serves as a litmus test: holding here could propel DOGE toward $0.30-$0.35, reviving bullish momentum last seen in early 2025. Market volatility spiked during the sell-off, catching many traders unprepared for the sudden reversal.

Grayscale Files For New Dogecoin ETF Amid Approval Expectations

Grayscale has submitted updated paperwork to the SEC, seeking to convert its existing Dogecoin Trust into a fully-fledged ETF. The proposed fund, trading under the ticker GDOG on NYSE Arca, WOULD provide mainstream investors with regulated exposure to the meme-inspired cryptocurrency. Coinbase is slated to serve as both custodian and prime broker for the vehicle.

The MOVE comes as demand for crypto ETFs gains momentum across Wall Street. Osprey's competing Dogecoin ETF (DOJE) attracted $17 million in its debut session, signaling institutional interest in meme-coin products. SEC rule changes appear to be accelerating the approval pipeline for such offerings.

Dogecoin's price has shown renewed bullish activity following the announcement. Market watchers are now speculating whether this institutional endorsement could trigger another significant rally for the cryptocurrency that began as a joke but continues to demonstrate remarkable staying power.

How High Will DOGE Price Go?

Based on current technical and fundamental analysis, DOGE shows potential for movement toward the $0.30-$0.35 range in the medium term, with $0.50 representing a bullish scenario dependent on ETF approvals. According to BTCC financial analyst Olivia, 'The combination of oversold technical conditions and positive ETF developments creates a favorable risk-reward setup. However, traders should monitor the $0.208 support level closely, as a break below could delay the recovery timeline.'

| Scenario | Price Target | Key Conditions |

|---|---|---|

| Bullish | $0.50 | ETF approval, increased network activity |

| Base Case | $0.35 | Technical rebound, sustained whale accumulation |

| Bearish | $0.20 | Support break, continued selling pressure |